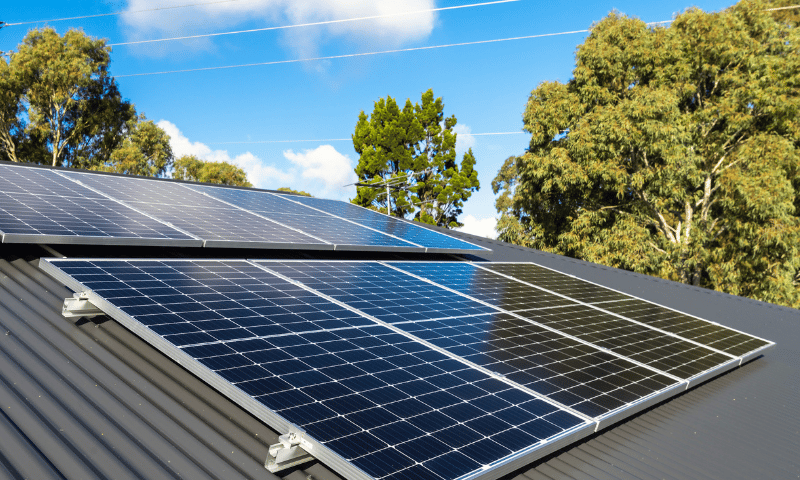

A loan for solar panel financing is an excellent way to finance your solar panel investment. The loan can be obtained for as high as $100,000 and paid back over a period of between two and seven years. This type of financing comes in many forms, including unsecured and government loans.

Getting a loan for solar panels

There are many options available when financing solar panels. Your credit score plays a significant role in determining the loans you are eligible to apply for. A good score is usually at least 700. People with bad credit may be eligible for loans, but the rates are more likely to be higher. Consider a cosigner if your credit score is low.

The loan is usually repaid in a specified amount of years. This makes it ideal for homeowners who plan to remain in their home for several years. Generally, it will take between eight and 20 years for a solar energy system to break even.

Government loans

If you are thinking about getting solar panels installed, you should know that the government offers loans to help you with the cost. You can even get as much as $500,000 to help with your project. However, if you want to qualify for this loan, you need to have a good credit score.

Solar loans have very low interest rates, which can help you save significant money over the life of your loan. A difference of even 1% could translate into significant savings over your loan term. However, if you are not able to improve your credit score, solar panel installation might be delayed.

Unsecured loans

Unsecured loans are a great option for those who want to make solar energy an integral part of their home. Unsecured solar loans offer lower total costs but may not be the right option for your financial future. Solar panels can be a great option if you are looking to sell your house in the future.

Unsecured loans for solar are available from many sources. There are also banks that specialize on solar loans. Another option is to join a credit union. These lenders have lower interest rates and unique customer requirements. These lenders do not have physical locations. The entire process can be done online and you must be an active member of the organization in order to qualify.

Home equity loan

A home equity loan is an excellent option to finance a system of solar panels. The amount of the loan will vary depending on how much equity you have in your home as well as other factors, such income and credit. A fixed interest rate is a type of loan that will provide a steady monthly payment.

Home equity loans typically have lower interest rates that other solar loans. This is because they are secured against the home, which means that they carry less risk. The best interest rates will help you save money in the long term.

Power purchase deals

For homeowners, businesses and communities, power purchase agreements that include loans for solar are a popular option to buy solar power systems. These agreements allow customers to purchase energy at a reduced rate, usually lower than what their utility charges. These agreements allow customers to plan for long-term electricity costs. In addition, many power purchase agreements allow customers to extend their contracts or purchase the solar system outright.

Many times, the PPA will also include improvements to the site, such as tree trimming. In some states, these RECs can be worth hundreds of dollars. These RECs are only available to utilities that meet a minimum threshold. This is often very high.